Should We Announce Our Conference Participation via Press Release??

We recently answered this question from a smart IRO and thought we should share the “Catalyst View” on the topic. The questioner also mentioned that it seems companies are announcing their conference participations less frequently than in the past.

We believe the answer is not about “what most companies are doing” – but what makes sense for your company given its size and IR goals. What a mid cap or large cap can do/get away with given the focus their size demands from the sell-side and buy-side, is likely not appropriate for small and microcap companies struggling to grow their audience within a shrinking base.

For small-, micro- and nano-cap companies, issuing a press release about your conference participation is a smart way to leverage your investment of resources and management time to participate, and can only increase your potential for reaching new or less-engaged investors. Of course, if there is a public webcast, there is a clear Reg FD compliance benefit for announcing your participation and your specific presentation slot. We think that the sponsoring firm will also appreciate your creating greater visibility for their brand and the event.

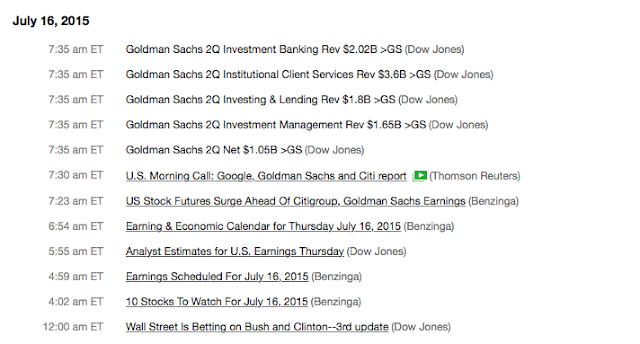

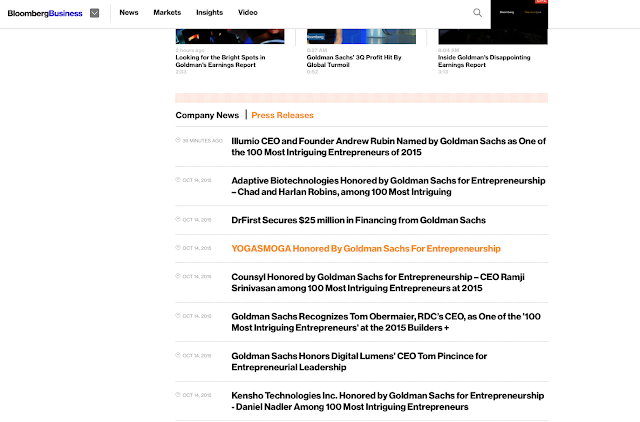

A release also demonstrates a proactive approach to marketing your story to your investors and investor prospects: you are getting out and meeting with investors, something that should be appreciated by most shareholders. The $300-400 wire fee (use the cheapest state or city circuit that gets you the database feed into financial portals) seems a great IR investment. You can also use the release to direct investors to an updated or current PowerPoint or other IR materials – as well as to remind them of what you do or any particular valuation attributes.

Now let’s talk about a conference release with the greatest impact

We find most companies issue releases with a headline along the lines of “XYZ Industries Announces Participation in Drexel Burnham High Yield Conference.” We believe this approach is tailored for those who know you – the already converted, but can fail to make it clear what your company does – what sector you are in – unless your corporate name makes it very clear, like “Anvil Industrial Metal Fabrication Corp.” A press release that isn’t optimized to communicate to the broadest possible audience, particularly those that don’t know your company, will likely provide far less visibility / ROI than one that helps to clarify what you do such as “Aviation Services Provider XYZ Industries…” This approach should also significantly optimize search engine placement and prospecting email blasts, increasing the number of investors that “click through.”

So we’d suggest something like “Branded Apparel Producer Smith Industries to Participate at Kidder Peabody Consumer Conf. Wed. Dec 7, 2019 in NYC” – that dials in what you do, what it is about AND when and where – so a quick glance would inform a new or existing investor of the opportunity and let them quickly determine if it’s relevant / possible to attend. Going one step further, if you do plan to webcast your presentation, we would focus the headline on that:

“Branded Apparel Marketer Jones Corp. to Webcast Bear Stearns Consumer Conf. Presentation Wed. April 7th at 11am ET”

The same is true for any email blasts you send to investor targets via BD Corporate or other services – the email subject line should help then assess the relevance – and in this case the market cap might help further qualify the reader’s interest.

So we feel the “to release or not to release” question about conferences and everything else, frankly, should evaluate the use of an enhanced release headline and release content optimized to introduce new investors. With that added view, the value/ROI of issuing a release becomes more compelling.

We warn you that this advice seems to be largely ignored by the bulk of public companies, and frankly we are not sure that Apple, GE or Caterpillar really need to explain what they do in their headlines (but we’re pretty sure it wouldn’t hurt them). However, the markets have changed dramatically the past few decades and surprisingly IR practices have remained remarkably unchanged. Unfortunately, with the steady move of capital and sell-side resources to larger and larger capitalization companies – decreasing the pool of interest for small & microcap investments, we believe that not evolving your communications thinking can exacerbate the challenges you face in finding new investment community support and engagement.

The questions that you need to answer at every step of the IR communication process are: Does the approach we have taken in the past make sense for what we are trying to achieve today and in the future? What holds us to the status quo? What is the downside of trying a new approach? and What’s Our Answer to the Board/C-suite for why we are doing things in a certain way?