-

Lost corporate and management credibility

-

Declining market value

-

Reduced trading liquidity

-

Damaged business reputation + customer & vendor concerns

-

Negative media & social media attention

-

Market delisting

-

Increasing vulnerability to activists or hostile suitors

-

Reduced access to capital + increasingly negative terms.

-

Narrowing share ownership

Visibility + Credibility.

One without the other will get you nowhere.

More than any other publicly traded entity, small-cap companies have an uphill battle in the fight for investor attention.

Is your message credible?

Visible?

What word of mouth have you established?

How are you earning the trust and attention of The Street?

Attention. Trust. Credibility.

Table stakes in the world of investing, really.

The challenge is that these things are simply tougher for small-caps.

You know how hard you’ve worked to get to this point. The years of R&D. The thousands of man hours. The long days at the office and untold sleepless nights, worrying and wondering.

All to finally go public.

And you’re proud of it. You’ve worked like crazy to invent new value, win marketshare, and earn the right to ring that bell.

So it can be particularly frustrating when after all of those years of toil, you sit back, ready to drink in the rewards and hear…

Crickets.

Nary a blip on the radar. A ho-hum reception, and missed targets on the capital you were hoping to raise.

I mean, you knew that your stock was never going to be the Facebook IPO, but the silence is deafening.

Why the apathy? You have solid numbers.

Why aren’t investors at least taking a look?

Why is your company’s stock – left flapping in the wind?

The answer is manyfold, but it’s rooted in gaining a new perspective.

And that is this;

When it comes to investors, your stock is the product.

A product that now sits on the ‘financial shelves’ alongside thousands of others.

A product with a complicated decision matrix for your buyers…

Let’s compare your stock with another purchase with a complicated decision matrix; buying a new vehicle.

When buying a new car or truck, most of us begin with deeper needs.

Often, it begins with status.

What kind of vehicle do we want to drive?

The brand. The make & model.

The fact is that is that story we tell ourselves about how it will feel to drive that new SUV, didn’t just happen by accident. There’s a good chance the automaker planted the seed of that experience and have been nurturing us along for some time. Through dozens of different brand touch points, they repeatedly invited us into a new narrative about what we drive. One that we’re now ready to make into reality.

Once we’re sold on the inherent brand story of the vehicle, we typically move on to more practical concerns:

- Is this make and model a good investment?

- How do current owners rate and review it?

- Has it won any awards?

- Fuel efficiency?

Typically, a ‘short list’ of factors emerges – ranking our investment options by price point, reliability, aesthetics, features and performance characteristics.

If the automaker has done their job, they’ve created enough story & credibility to justify a visit to the showroom.

Finally, if the product meets our test drive due diligence, and we can afford it, we’ll pull the trigger on the investment.

While buying stocks are not as tangible as buying a new car, the decision process can share key similarities. And contrary to what you might think, it’s not completely devoid of emotion.

In fact, for many, it begins there.

- Have I ever heard of this company?

- What is its story?

Awareness. Brand recognition. Trust.

Is this a story that I can buy into?

In the world of investing, blue-chips often have the most trustworthy of stories.

Established and well-recognized.

Large in-house IR teams to communicate it all so well.

And for big segments of retail investors, that’s all they’ll ever believe in. Stock brands and stories for low-risk, long term portfolio strategy. The folks that wouldn’t think of buying a new car brand that they’ve never heard of. The people who passed on Tesla early-on, until the company became known as, well, Tesla.

But there’s another group of investors out there.

That’s who you’re seeking.

The open minded investor who’s on the hunt for a high quality, emerging company like yours. The leaders who would respond positively to a well crafted nurturing campaign.

The small-cap investor.

The good news is that there are a lot of them out there.

The challenge for you is that these investors have thousands of choices.

- Why should they invest in your company?

- What compelling reasons have you articulated?

- Are you staying in front of them with the ongoing story of your business growth?

It takes a lot of work to hone in on these answers. And it requires even more work to develop the systems needed to nurture investor leads through an opportunity funnel.

So much work that for small-caps, it rarely gets done.

Why?

Because IR outreach and messaging is a full time job. And not an easy one. Few small-caps have the in-house resources needed to generate a steady stream of interest to raise capital.

That’s where Catalyst IR comes in.

We’ve been at this for over 30 years. We know what works and what doesn’t for companies like yours:

- What outreach campaign should be employed at initial offering?

- What messaging is best for early, mid or later stage small-caps?

- How can credibility be developed if no one has ever heard of you?

There are no easy answers, only quality decisions rooted in the highest probability for positive outcomes. Decisions and positive outcomes that can only come from deep experience.

Believe us when we say that you don’t want someone learning on your dime.

Stick to your Core Competency

You have a company to run.

That’s why our approach is a done-for-you solution that frees you up. No more nights and weekends trying to hammer through it after hours.

Our team is uniquely prepared to come along side yours, as a virtual in-house IR team, so that you can focus on what you do best; building your company and delivering on shareholder value.

The Result?

Investor Interest, Confidence & Engagement.

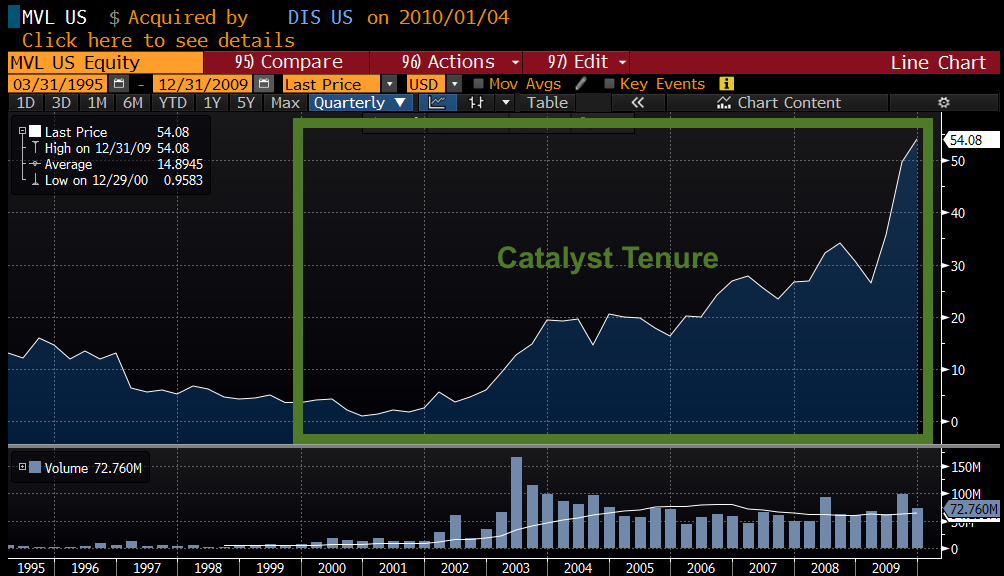

Case Study:

MARVEL ENTERTAINMENT

Retained as IR counsel in January 2000, after Marvel’s exit from bankruptcy

Situation:

- Marvel characters acquired out of bankruptcy by a toy company

- Cap Structure: $145M market cap + $250M Preferred stock + $200M high yield debt

- Business was largely toys, along with licensing and publishing – no films

- Wall Street had forgotten Marvel after 4 years of bankruptcy proceedings

- Marvel retooled itself: outsourced toy operations, focused on licensing, refreshed characters and grew comic publishing, benefited from licensed film productions and ultimately secured non-recourse funding to initiate its own productions

Program/Results:

Served Marvel 10 years as outside IR counsel.

- Strategic counsel on rebuilding awareness, building awareness outside toy sector, balance sheet enhancements and array of issues

- Reinitiated sell-side & buy-side outreach – focusing on leisure, consumer, media & entertainment investors

- Shaped Street perceptions of evolving Marvel; secured increasing transparency and management access to support Wall Street interest

- Developed focus/respect on impressive & unique operating discipline & cost consciousness

- Led several crisis management situations around deals, litigation, product liability, etc.

- Built base of 17 covering Sell-Side analysts

Ultimately Marvel profile attracted acquisition by Walt Disney in Aug. 2009; deal closed Dec. 2009 at $4.4B equity valuation.

(Above: Marvel share price chart. Catalyst IR began counsel in 2000.)

Ready to expand your investor universe?

Get the Sell-Side Shortlist

What is the Shortlist?

Catalyst will research and identify a universe of sell-side analyst targets as well as institutional and/or high net worth investors, that are appropriate current or future targets for your company. This research is based on our proprietary investor database, licensed Wall Street databases and proprietary research.

Prefer a Buy-Side Shortlist? We can do that too.

Start gaining new investor traction.

Get the Shortlist.