Investor Relations Counsel

- Positioning & Valuation

- Guidance & Expectation Management

- Perception Research & Feedback

- Capital Markets Guidance

- Reputation Management

- Crisis and M&A Strategy & Communications

We deliver individually crafted counsel, outreach and solutions for each client.

There has never been a more challenging environment for finding and attracting new investment interest in small caps. One of the reasons is that many ideal investors do not show up in regulatory filings – they are invisible too! It is a complex, relentless process made up of an ever-changing roster of players and shifting rules of engagement.

Catalyst IR helps our clients build a sustainable following on Wall Street by reaching out both to thought leaders to cultivate relationships over the long term and to investors that we think could move to engagement more quickly.

The goal is to build lasting relationships, conviction in a company’s business plan and trust in management – ties that can deliver substantial value and also endure business cycles, market swings and investment fads.

Leveraging our decades of experience and relationships, our peer/quasi-peer analysis and tapping BD Corporate and internal database of investors, Catalyst IR identifies suitable targets, initiates dialogues and qualifies targets for escalation to management dialogues. From there we work to develop long term engagement ongoing communications, meetings and marketing. At the same time, we work to educate our clients on the financial dynamics of the sell-side business model so that the IR program can work to optimize the relationship.

Small-Caps cannot wait around to be found by investors, so Catalyst IR reverses the process and finds appropriate investors to introduce to your company. We do all the leg work to find and qualify investors before we take your time to make direct introductions. Often this effort will also include some component of retail or small institutions – that are active in small-cap investing. In all cases, we make sure we are reaching out to the audiences most likely to be attracted to your story.

Conferences, road shows and other marketing events are the most effective use of management’s time. Catalyst IR develops such opportunities and coordinates every detail. Additionally, we also provide in-depth briefing documents that explain the background and rational for each investor that you meet. Catalyst also leverages the power of your product or service buy finding ways to make it a core part of investor interactions. Let your offerings help you sell your investment story.

Tracking and managing your investment community prospects and interactions is a critical aspect of a successful IR program. Similarly, providing prompt and professional responses to investor inquiries is another key aspect of successful IR – and putting us on the front lines helps our clients stay focused on advancing their business. Catalyst uses Salesforce.com to manage each of our client’s investor universes. Over time, we have grown our proprietary database to over 19,000 institutional and individual investors. We utilize this powerful to manage client email lists as well as to conduct targeting and outreach activities.

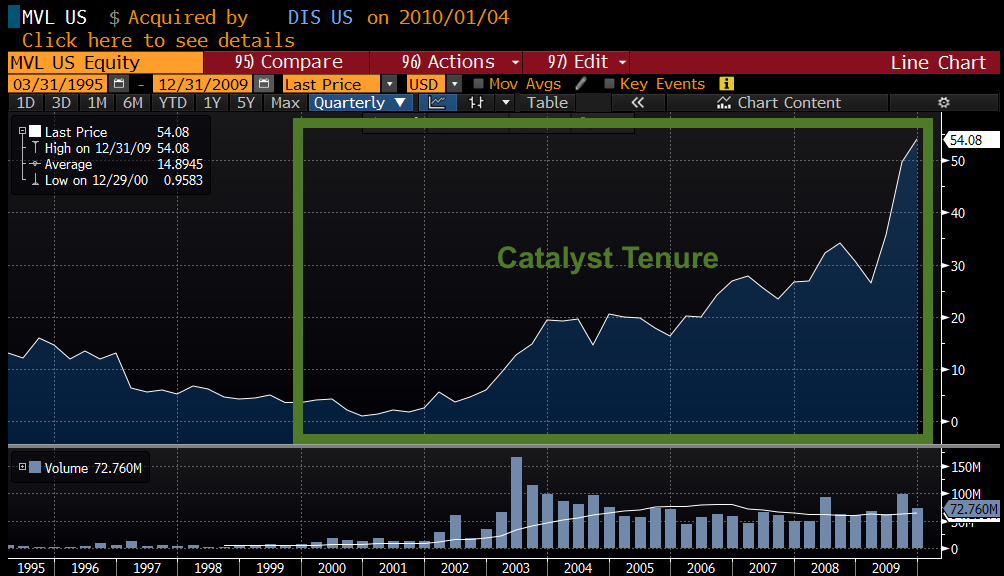

Retained as IR counsel in Jan. 2000, after Marvel’s exit from bankruptcy

Served Marvel 10 years as outside IR counsel.

Ultimately Marvel profile attracted acquisition by Walt Disney in Aug. 2009; deal closed Dec. 2009 at $4.4B equity valuation.

(Above: Marvel share price chart. Catalyst IR began counsel in 2000.)

Monthly insight and counsel on the state of Small-Cap Investor Relations