Are Quarterly Press Releases Optimized for Reach and Impact?

David C. Collins, Anna Vikentiev

Catalyst Global

LLC

November 14, 2016

first introduced 110 years ago by Ivy Lee, considered the father of modern

public relations. Lee’s agency was working with the Pennsylvania Railroad to manage

communications around the 1906 Atlantic City train wreck.

The release was provided directly to journalists, before other versions of the

story could be spread and reported.

|

Ivy Ledbetter Lee

|

and disclosure has changed radically. Press releases are distributed via paid

wire services instantly and simultaneously to the media AND everyone else, with an immediate social media feedback

loop attached. The speed, breadth of reach and mode of access to press releases

could not be more different, yet how

have investor communications evolved to adjust to today’s completely different

paradigm?

release practices, we focused on quarterly results press releases – the

workhorse of IR messaging. Though

voluntary, quarterly releases are used widely to communicate to investors about

a firm’s financial performance. A 2006 study by Dr. Elaine Henry confirmed that

investors are influenced by how earnings press releases are written, and Warren

Buffet has stated he would not invest in a company whose disclosure he cannot

understand, because this implies intentional obfuscation. [1]

quarterly releases issued on three randomly selected days in July and August

2016.

difference between “disclosure” and

“communication” in quarterly releases…

criteria:

|

Quarterly Release Headline Analysis

|

Yes

|

No

|

|

Is there a financial measure in

the headline?

(i.e.

“EPS of $1.25”, “Net Income of $23.2M” or “Revenue of $3.8B”) |

9%

|

91%

|

|

Is there any indication of 1/4ly

performance direction? (terms like “record,” “rises,” “declines” or “improves”) |

18%

|

82%

|

|

Is there an explanation of

“drivers” behind the results?

(such

as “due to sales of the new software release” or “improved cost management and acquisition synergies” |

0%

|

100%

|

|

Is it clear what the company

does? / their general industry category? (United Rentals & Puget Sound Bancorp are clear, but it’s hard to guess what PTC, or Umpqua actually do…) |

58%

|

42%

|

|

Quarterly Release Headline

Content |

|

|

|

|

Action word:

|

Reports

69%

|

Announces

25%

|

Other

6%

|

|

Period Description:

|

Second Quarter

91%

|

Other

7%

|

None

2%

|

|

Is the Year Included?

|

Yes

83%

|

No

17%

|

n/a

|

|

What quarterly measure is reported?

*(Results 49%; Financial Results 30%;

Financial and Operating Results 5%; Other results 4%) |

Results*

88%

|

EPS

6%

|

Other

6%

|

And we also considered a few areas of release content:

|

Quarterly “Earnings” Release

Content |

Yes

|

No

|

|

Are additional tables used to

help illustrate the results? |

44%

|

56%

|

|

Does the release provide

perspective on future results / trends? |

70%

|

30%

|

|

Does the release explain key drivers

behind the results? |

94%

|

6%

|

|

Are comprehensive financial

statements provided in the release? |

87%

|

13%

|

|

Was the complimentary logo

provided in wire service version? |

71%

|

29%

|

are being written with existing investors as the principal audience. We come to this

viewpoint because few companies took steps to catalyze new investor attention by providing more qualitative

or quantitative information in their headlines to better illustrate the

investment to those who don’t know the story.

might assist a prospective new investor in determining that they should “click on the link” or “open the email” rather than ignoring the item and moving on – a lost opportunity

for new engagement.

companies that face challenging barriers for coverage or visibility of any kind

– making the optimization of their news release content even more critical to developing

new interest in (and demand for) their shares.

Press Releases Are Delivered and Consumed Today

has changed from a time when the media was THE gatekeeper and the principle conduit of news and information. Today, financial

news releases are disseminated instantly, globally and are consumed directly by investors in an electronic format either online or via email. Can you recall the last time you read breaking news

on paper?

delivery, quarterly news release visibility is distilled down to a headline

hyperlink on a web page or an email subject line, and both require a definitive

action by the viewer to see more – including any sub-headlines, highlights, tables

or the full release.

background, historical perspective, informative links or insightful management

commentary are for naught – if the prospective investor is not persuaded to

click your headline link or open your release email. For that reason, we counsel

our clients to differentiate their headlines to make them more effective in

communicating specific information about your company.

headlines lack such enhancements to better stimulate engagement and further review.

Said another way, most releases inherently assume they will be read and/or they

seem to assume some level of subsequent dialogue or research on the part of the

investor.

how to optimize the reach of quarterly releases– while not negatively impacting

the dialogue with those already converted.

replace with value-added content such as the date and or time of the webcast!

Investors are busy – get to the point, make things easy for them – plus fewer

words are cheaper!

Report Fiscal 2016 Third Quarter

Financial Results of Operations and Host an Investor

Hosts

your company name does not clearly explain your business, add a phrase in your headline to clarify your sector/industry to

increase the odds your news will be discovered by editors, investors,

reporters, blogs, other industry participants and search engines interested in

your sector.

than:

Solutions Provider Company X …”

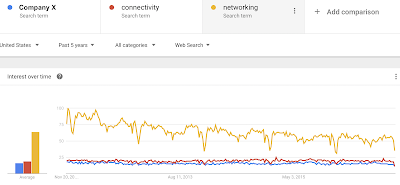

The blue line shows search activity for the Company name, and the red and yellow lines represent search activity for the words “connectivity” and “networking.” Clearly, by simply adding the word “networking” to their press release headline, Company X would benefit from much higher visibility and potential discovery via searches or data mining / data analytics.

net income, EPS, etc.) in your headline to provide a clear window on the scale of your business and

valuation, relative to readily available share price/market cap data, to help

readers assess your story’s relevance to their strategy.

Quarter …Results”

suggest:

to your headline to attract new investors with appropriate investment styles (growth, special

situations, turnarounds, value, etc.) Getting the direction of your performance

out more broadly – whether up or down – should reach more new relevant investors.

suggest:

Revenues Rose 22% to $125M”

A

step further would be to explain a key

driver behind the change of the measure.

We suggest:

Revenues Rose 22% to

by New Distribution Relationships”

or

“[Specialty Chemicals Distributer] Z Corp. Q2 Revenues declined 17% to

we recommend that you include key

elements of your conference call comments in the press release, – not just on

the call which has a fraction of a release’s reach and engagement, particularly

with retail investors. This includes business drivers, industry trends and

management strategy that will impact your future results.

comprehensive financial statements in your wire service release, as 13% of

releases we surveyed did not take this simple step to push their financials to

investment portals on a global basis. This is where investors may first

discover you.

it clearly, a comparison table with

percentages is a great addition to a successful release. 56% of releases surveyed

did NOT take advantage of this opportunity. In our view tables with a % or $ change column make operating improvements far more apparent than do words.

We advocate adding more

content to your headline to make it more effective in communicating – rather

than merely disclosing your performance. Interestingly, 83% of the survey releases chose to clarify the year of the results they were reporting in the headline (when that is both understood AND clarified in the release itself), yet 91% of the releases chose to NOT reference any measure of

financial performance in the headline (despite that being the reason for the release), and 82% also

refrained from providing any directional context on their quarterly

performance.

releases. The bulk of releases surveyed

erred on the side of unembellished disclosure, to the detriment of their potential reach and utility. This approach also begs the question of why even bother issuing a release if it provides no more perspective or utility than the

10-Q or 10-K?

on Wall Street is time – not capital, making it incumbent upon the IR practitioner

to make it efficient and easy for investors to get to the data they need. The

fewer the steps, the more likely they will make the journey.

complimentary corporate logo in wire service releases. We were surprised to

find that just over 2/3rds took advantage of this free, easy to use

feature that provides a more compelling visual portrayal of your news that also reinforces your corporate branding. That nearly 1/3rd of releases did not use this free feature does make us wonder about their thought process in passing up the opportunity.

for the “communications” opportunities within quarterly and other news and at least

ensure that key decision makers are aware of the pros and cons of the current

approach versus alternatives that might enhance communications reach.

over decades of IR consulting. The status quo carries probably the greatest

weight in the homogenization of quarterly release content – with “we’ve done it

this way for years” or “it’s the way our leading peers communicate”

as two prominent justifications. We also know well the extra time and attention that required to successfully champion such changes – both to develop and then advocate for and defend. Even a receptive audience will often want to table changes until “next

quarter,” when the sponsorship burden reemerges.

we believe the questions the data raises are germane to the ROI of today’s IR

communications. These questions include:

your headline?

intern and Fordham Gabelli School of Business Master’s Degree candidate in

Investor Relations, who conducted the research and contributed to the writing

of this article. Without Anna – this would still be an idea.

research findings and recommendations.

[2] Opportunistic Disclosure in Press Release Headlines. Saorin, Osma, Jones. Accounting and Business Research, 2012

Leave a Reply

Want to join the discussion?Feel free to contribute!