The Social Media conversation is taking place across all aspects of corporate and investor communications and seems here to stay. After nearly a decade of direct engagement in investor relations social media communications, the Catalyst team’s view is that companies cannot afford the luxury of ignoring this conversation, and some level of engagement makes sense for all companies – today.

The question is not if you will become engaged in social media, the question is when and how you will engage and how those actions will reflect on your company, its management team, industry position, crisis management abilities, and credibility with your various stakeholders.

From an investor relations standpoint, social media has been treated like an electrified “third rail” fraught with danger and to be avoided at all costs. The last study we saw said that roughly 70% or more of IROs stated they are not engaged in social media and have no intentions to do so. Given the extent to which legal concerns have been defanging effective investor communications over the past decade, this conservatism is not surprising.

What is surprising is the extent to which the IR community continues to justify its lack of social media engagement by looking inward – principally at peers and others that have not yet ventured into the water. Using tepid levels of engagement as a yardstick, much of the IR community still seems comforted that abstinence is an appropriate strategy, a position that is often validated by counsel and others who are not judged by metrics of investment community engagement.

Catalyst takes a pragmatic approach to assessing the value of Social Media for Investor Relations and corporate communications: What value can it deliver for our clients? With what investment of time and resources? With what risks or opportunity costs.

From a risk standpoint, we are comforted by the SEC’s clear support for the use of social media to disclose material news. While Catalyst does NOT advocate social media play the lead in this important role, but rather as a supporting channel to more traditional methods, the SEC’s guidance on the topic provides clarity and regulatory cover for companies to engage in reasonable social media activity.

So why should you engage in social media for IR purposes?

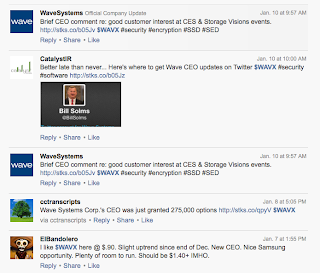

1) To ensure your messages are clearly and regularly conveyed within the existing dialogue going on about your company anyway – rather than to keep your head in the sand to ignore the conversation. (Do a search on Twitter or StockTwits or SeekingAlpha to see what is being said about your company.)

Are you satisfied with the portrayal? The balance of fact and opinion? The accuracy of data provided? The nature of those engaged in the conversation? Would this dialogue be enhanced by a regular stream of fact-based messaging from your company pointing to your formal disclosure activity and reinforcing your strategy, goals and progress while also drawing attention to your IR communications efforts/opportunities?

2) To get your story in front of new investor, customer, partner & media eyeballs for the first time, or to remind those who have forgotten about you or are not thinking about you, to take another look.

We find this to be the most compelling reason for social media engagement and here’s why:

If you think about conventional corporate and IR communications, they consist of news releases and SEC filings tied to your name and stock symbol. They are pushed out electronically to a broad variety of financial databases & media sources where they are referenced and searchable typically based only on your name and stock symbol, and in some cases your industry segment.

With over 10,000+ companies and likely 1,000s of communications per day – there is much for investors and databases to wade through. Few investors have the time to watch a stream of headlines run by in the hope of discovering a compelling investment idea (which gets us to the importance of your headline (represented as a hyperlink to the release) , but that’s another issue where we also have very strong opinions in conflict with the status quo!).

SOCIAL MEDIA HELPS REACH INVESTORS THAT HAVE NEVER HEARD OF YOUR COMPANY OR STOCK SYMBOL or have forgotten about you. Unless you are Walmart, Google, Exxon, etc., your news will likely not rise to the surface in media or other coverage that investors might encounter without searching for it.

Instead your news will be neatly filed in what we think of as “digital drawers” identified only by your name and symbol. Only those investors who own or follow your stock will ever see your news, unless something is done to get that days news and your Company exposure OUTSIDE of your digital drawer.

Exposure of your Company and news “outside your digital drawer” is where we see value in social media engagement. Through social media postings you have the ability to get your news flow in front of investors, traders, media, bloggers & social media participants, often for the first time. This is accomplished through careful messaging + proper referencing of your news to industry topics, peer companies and social media sources, so that those tracking certain subjects or companies will come upon you and your story. Given the vastness of social media activity, this process does take time, but we have found that you can build an audience for your company and investment thesis with new investors, one person at a time. For small cap and microcap companies in particular, such progress can be quite meaningful.

Via social media you are also able to build a base of participants that you follow and many will begin to follow your company as they discover you and find that your business and outlook are of interest. We can think of no more cost effective way to add new relevant followers to your base of investment interest.

The only cost is the time you expend to develop social media posts and to engage with those you identify. It can take just a few minutes or as much time as you care to devote to it, the decision being made based on the value you see from the effort.

3) To demonstrate proactive communications and engagement to a variety of stakeholders. Being active in social media makes a statement, just as being invisible makes a statement. Your communications posture and engagement are integral components of your corporate and IR brand – they speak to the values and goals of the management and board.

While an oft heard critique of social media in the IR realm is that institutions are not paying attention, are not relying on it – more and more research shows this is not the case and report on the extent to which the influence of social media is growing amongst institutional investors. A recent poll we read suggested ~40% – we’ll correct the number if we are wrong – of institutional investors rely on some aspect of social media in their investment process.

That Bloomberg has built an analytical tool based on Twitter activity and that major financial portals and online brokerage firms have incorporated social media feeds into their investor dashboards suggests this medium is relevant and here to stay. Much of this activity is linked to “sentiment” indicators derived from social media activity. This begs the question, as an IRO are you content with having your Company’s investment sentiment indicators solely influenced by an unwatched bunch of strangers? Similarly, are you able to support the position of not entering the conversation and not seeking to ensure that these sentiment measures reflect both the facts and your Company’s view?

Finally, social media also appears to be a community effort with a “one hand washes the other” dynamic. Raising the profile of other’s posts and news, over time, should increase the likelihood of their seeing your content as well as their reciprocating in some constructive fashion. A community of individuals shows up each day to expand the visibility of their narrative – and by participating and sharing in that process you are able to benefit from the same.

4) To expand media & online exposure and coverage of your company. Many top journalists for print, TV, radio and online outlets, as well as industry trade press and bloggers are active in social media. This presents another great opportunity to build awareness of your company and your news flow while also garnering a window on what they are thinking.

5) To protect your brand and put in place a credible information conduit in the event of crisis. If you haven’t staked your social media turf, someone else might do it for you, with alarming consequences. Fake accounts, spoofs, etc. are more likely to happen if you have not established known and trusted social media accounts with a history of activity that investors can rely upon as being “official.” Social media can be a hugely valuable conduit of information to all stakeholders should your company experience a major crisis or challenge, including website, power or telecom outages.

These reasons alone make taking initial steps in social media engagement a no-brainer. The risks of engagement in our experience over many years are limited relative to opportunity cost of not-engaging, particularly as social media evolves (and we grows in influence) over the next few years.

Those not engaged seem to bet on social media being a fad that disappears and makes them look prescient. We have no crystal ball, but based on what we’ve seen, we are confident that is not a likely outcome. However, we also admit that social media will continue to evolve to meet the needs of those who are engaged and for that reason any effort much remain flexible and open to change.

We recognize that social media seem scary to those who are not experienced in the practice, particularly Boards and C-suite executives that are responsible for setting the non-social media path. We are concerned the recent Twitter disclosure debacle is being used to justify the the “just say no to social media” posture, though as an isolated and easily preventable incident it does not seem a reason for companies to keep their heads in the sand.

Catalyst Global is Here to Help

In our view, the risks of modest engagement on the IR front are limited if you follow a well thought out plan. We also believe it will be increasingly hard to defend a “head in the sand” social media posture. Getting engaged and informed on what it is and how it can help you is the best offense and defense.

Catalyst’s social media focus is to provide counsel and support for companies looking to take the first steps into social media for IR. We have been actively engaged in social media in the investor relations and corporate communications space for over nine years and through those efforts we have developed a solid base of understanding of the medium and how it can be harnessed for expanding IR visibility and IR community support.

Our role is to help you understand the value of the effort and to help you formulate a path for initiating an IR social media presence. Our preference is to provide the counsel and guidelines to support Companies building their own in house efforts, and from there we are able to provide ongoing oversight and advice as requested.

Social media is NOT an IR PANACEA, but particularly for smaller companies that are not the subject of active media or other coverage, social media can deliver exposure you otherwise could not develop. And there are metrics you can track that demonstrate a growing base of engagement by investors, media, bloggers, traders, industry groups and partners that will help you justify the effort.

Social Media Tips

For those already engaged in social media in some fashion, we offer a few social media tips to which we may add others going forward…

Create an IR-Specific Social Media Presence – Because investor relations information and perspective is often different than normal corporate, sales, marketing or other company communications, we believe your IR social media efforts should be conducted in a separate account that is clearly noted as being for IR use. Our practice is to use “IR” as the suffix for such accounts and we see others doing this as well. Of course corporate and other accounts can support each other and share similar messages as circumstances and strategy suggest. Leveraging consumer or industry awareness to introduce an IR opportunity can make a lot of sense for some companies.

Use Stock Symbol References – Stock symbol nomenclature was started at StockTwits and later adopted by Twitter and other sites. In most IR related posts, you should append a dollar sign ($) prefix to your stock symbol as in: $IBM $GOOG, $AAPL. The $ identifies a stock symbol, creating a searchable reference for investor-related posts. While you can search a symbol without the $ sign, it will yield a good deal of non-relevant material, not a focused set of stock related data.

As an example, the post below used #MUX to denote the stock symbol rather than $MUX. As a result, those searching for news on $MUX would not find this or other Company posts.

Searching on #MUX will yield posts on a variety of non-stock topics including a home delivery service in Pakistan!

This hold true for posts relating to public company partners, customers or even industry peers; make sure to use the $ approach. In our experience, posts that include multiple stock symbols, properly referenced, achieve several fold greater visibility and engagement those with just one client symbol.

Social Media Sharing Functions – This is a simple but often missed visibility enhancement for both the entity who’s content you are “retweeting” or sharing as well as for the subject of the retweet/sharing. If it’s your website’s retweet function, you should reprogram it to enhance the reach of the retweet activity for your social media posts.

We’ll use Twitter as the example for what we mean, but it’s relevant with other social media services. The problem is that often when you click on the “share” button to retweet or share a social media post, the social media “handle” or account name for the source of the post is not properly identified with their searchable social media name (which in the case of Twitter is signified by the prefix “@” as in @CatalystIR NOT CatalystIR NOR #CatalystIR)

To share the following trade publication article via Twitter to highlight further industry demand for fingerprint biometrics in support of a client…

We clicked the Tweet button to share on twitter and here’s the text the site’s share function provided:

The Tweet function failed to include the source’s proper Twitter “handle” @BiometricUpdate and instead provided “BiometricUpdate” (without the Twitter @ signifier that creates a hyperlink to the source’s Twitter account). This reduces the visibility and interactivity of the post for both the source and the reTweeting party.

Catalyst revises the automated text to include the correct @____ handle while adding appropriate $stock symbols and keywords to optimize the post for greater visibility and referencing.

Autoposting – In an effort to streamline workflows and time investment in social media, some companies rely on social media “auto-posts” of their news announcements or SEC filings. Such posts are created automatically but can vary in their effectiveness. The auto-posts at issue tend to provide little or no relevant information to help readers understand nature the post or the posting entity and/or why the reader should “click through” to read the post.

Often it’s just a mysterious hyperlink with little or no information. Such posts often fail to include a stock $ymbol reference and lack any hashtag references that would help position the post in front of those with relevant interest.

At their worst, such auto-posting provides virtually zero assistance while demonstrating a lack of appreciation for the intended audience or their information needs which could even prove damaging to investor relationships over time.

Auto-posting functions via email programs like ConstantContact and some of the newswires create posts based on your press release copy, however you should always review the proposed message and revise it to optimize its efficacy.

Pictures and Video – Where possible, add pictures or video to your social media efforts to enhance your communication and to attract more attention. Scroll down the postings on StockTwits and you will see how much an image expand the real estate of you post and helps to attract attention. While the image function seems focused on stock charts, any photo will work.

StockTwits Syndication – StockTwits is a “Twitter-like” social media service catering specifically to investors. It provides a targeted audience for IR efforts (though the site does seem to skew more to traders than fundamental investors) and pioneered the $ stock symbol nomenclature mentioned above.

Companies pay a modest fee to established a validated corporate account so that investors can be certain that the messages are coming from a Company’s IR team or they can just establish a no-fee account.

Beyond the visibility you can achieve on the site yourself, StockTwits content (including the posts that you make) are distributed / syndicated as a feed into other financial portals including those referenced below (though the list does seem to change as relationships come and go).

We posted the following “Twit” (that’s how we differentiate from a “Tweet”) on behalf of our legal technology services client, Epiq Systems ($EPIQ) and is visible on Epiq’s CNN Money news page (as would anyone else’s post…). This feature allows you to get your message in front of a broader audience outside of your normal wire service and Edgar-based communications/disclosures. For that reason, we generally originate messages on StockTwits and then link that account to the Twitter account so that by posting one message you reach both channels.

To Tweet or to Retweet There’s a Difference – My colleague Tanya Kamatu taught me another Twitter trick just today that relates to using existing Twitter user “handles” (that’s what I call their account name that starts with an “@” sign such as @CatalystIR our firm’s Twitter handle) as part of your post. While this is not IR specific, the reach of your comment can be substantially limited if you don’t understand how things work on Twitter.

If you post a comment that starts with a Twitter handle, that Tweet will be treated by Twitter as a “retweet” and therefore not seen by the broader Twitter audience but only by those who follow both your account AND the @account that started your Tweet. To combat that limitation, you can place a period before the handle, as in .@Account – and then the comment will be seen broadly. This is only the case when the Twitter handle is the first element of a post, not when it’s later in the post. For more information on this topic visit thesocialu101.com

With that, I thank you for your interest and encourage you to get back to your own social media efforts or program evaluation. Catalyst remains bullish on the potential of this medium to support greater IR visibility over time, and we are eager to counsel companies on how to enhance or initiate a social media effort that adds value and mitigates risk.

Contact us if you are interested in learning how we can be of help.

Best regards,

David C. Collins

Managing Director

Catalyst Global LLC

212 924 9800